|

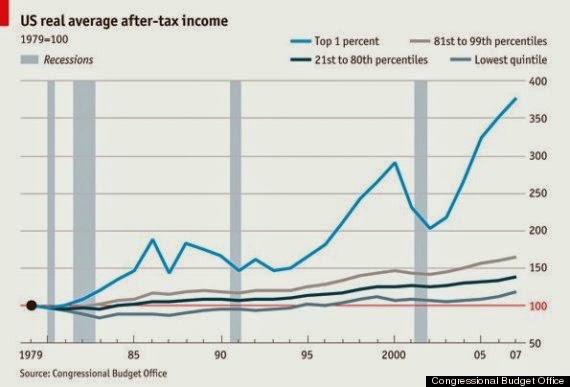

| Not a pretty picture. |

Ellison introduced the same bill last year on April 4, the anniversary of Martin Luther King's assassination. Rallies in 24 cities were held around the country that day to remind people that King died while fighting for the cause of economic justice.

Back then, Ellison said,

A lot of people in Washington like to talk about reducing the debt and deficits. Well if you really care about reducing the deficit, how about asking Wall Street speculators to pay their fair share? This bill will add a tax of a fraction of a percent on transactions made by the same Wall Street firms and stock traders who crashed our economy in 2008. This tax alone will generate up to $300 billion a year in revenue, stabilizing the deficit and allowing us to invest in the things that matter—education, roads and bridges, and health care for our seniors and veterans.Granted, Ellison has less of a chance of passing the bill this year than last because Republicans now hold more seats in Congress. But he deserves props for keeping the debate alive as more people recognize inequality in the United States is destroying both our economy and our democracy.

John Nichols at The Nation pointed out earlier this year that Ellison has helped persuade more centrist Democrats that a financial transaction tax -- albeit a small one -- is a good idea. In January, Maryland Democrat Chris Van Hollen presented an 'action plan' that framed his party's message in the new Congress.

Wrote Nichols,

The “action plan” calls for a 0.1 percent tax on transactions by high-volume traders—Wall Street’s “high rollers”—that would yield an anticipated $800 billion in fresh revenues over a decade. Reductions in tax breaks for the wealthiest Americans would yield another $400 billion. The combined $1.2 billion windfall would, according to a Washington Post review of the plan, help to fund “a ‘paycheck bonus’ of $1,000 for individuals and $2,000 for married couples, a bonus of $250 for people who save at least $500 a year and reduced ‘marriage penalties’ for couples.”

While the numbers may sound big, what Van Hollen has proposed is a modest plan that only begins to explore the potential of a financial transactions tax. The 0.1 percent tax on trades is far below what unions and activist groups have proposed. For instance, Ellison’s 2013 proposal called for a 0.5 percent tax rate on stock trades, along with a 0.1 percent tax rate on bonds and a 0.005 percent tax rate on derivatives or other investments.Financial transaction taxes are working in London, China, Hong Kong, Singapore and Russia. They can work here too. Let's keep Ellison's idea alive.